Donna GayleenKacy SallieTrude HorPippa Ferguson - Civil Service Mileage Rates in Ireland for 2025 Capture Expense, So for simple math, if your agi is $100,000 for the year 2025, and your medical costs are $10,000, you would be able to deduct $3,000 of your medical costs. Mileage Reimbursement 2025 Ireland Kania Marissa, If your medical and dental expenses exceed more than 7.5% of adjusted gross income (agi), you can deduct the overage.

Civil Service Mileage Rates in Ireland for 2025 Capture Expense, So for simple math, if your agi is $100,000 for the year 2025, and your medical costs are $10,000, you would be able to deduct $3,000 of your medical costs.

Mileage Allowance 2025 Ireland Lanie Lanita, Employers need to understand mileage and subsistence rates and, if not, take the necessary actions to rectify any issues in order to remain compliant from a paye perspective.

Mileage Reimbursement 2025 Ireland Della Farrand, Business travel is when your employee travels from one place of work to another place of work as part of their duties.

Mileage Allowance 2025 Ireland Becki Virginie, They are not required to pay towards the cost, or the running expenses, of the car.

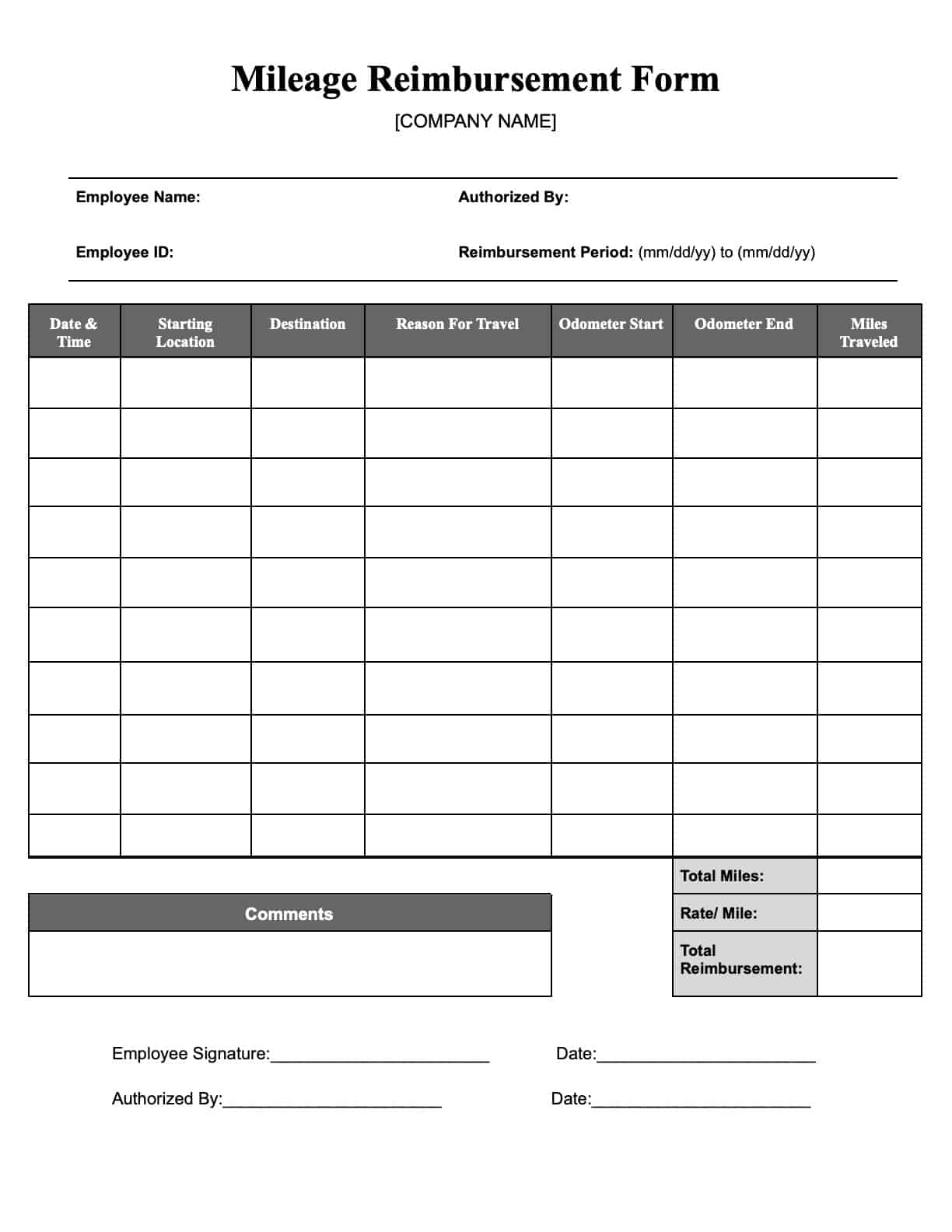

Revenue Mileage Rates 2025 Ireland Kirby Suzanna, You can repay your employees when they use their private cars, motorcycles or bicycles for business purposes.

Mileage Reimbursement 2025 Ireland. Travel between ireland and other countries. Includes the latest 2025 revenue guidance from ireland’s leading tax and payroll professionals and information on the 8,000km rule, evs, potential penalties and how to automate business mileage capture while protecting privacy.

2025 Mileage Reimbursement Rate Forms Dehlia Phyllys, Medical expenses are the costs of diagnosis, cure, mitigation.

Mileage Allowance 2025 Ireland Jilly Lurlene, — an employer in ireland can reimburse employees for using a personal vehicle for business journeys.

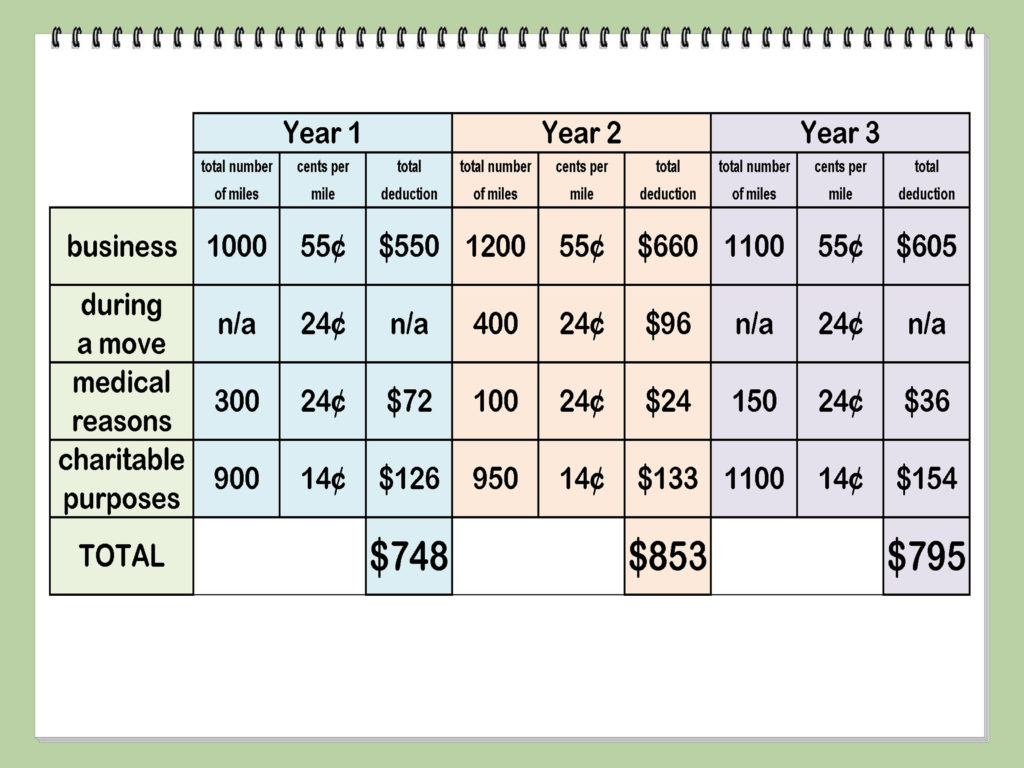

— yearly, tax authorities may update their vat, mileage and allowance rates. Assume my daily commute of 60 miles round trip for 23 workdays a month, the reimbursement would be $903.

Irs Mileage Reimbursement 2025 Maude Lilias, This payment can be made, tax free, by the amount of business kilometres travelled.

Mileage 2025 Leann Aindrea, — alternatively, i can use my own car with irs mileage reimbursement (2025 rate: